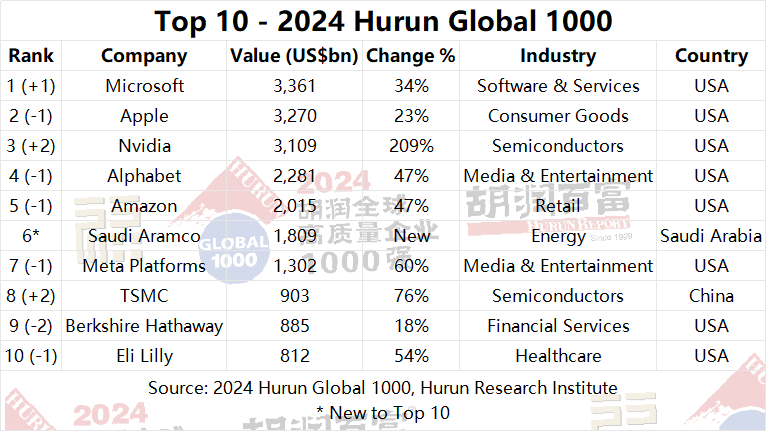

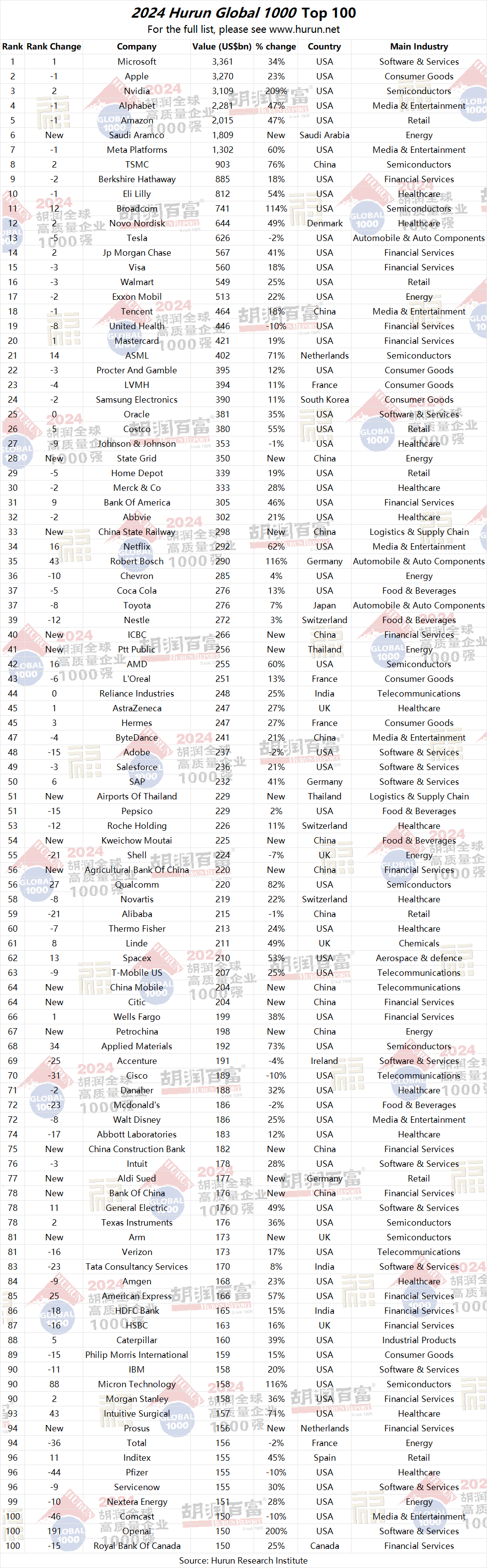

MICROSOFT OVERTOOK APPLE TO BECOME THE WORLD'S MOST VALUABLE COMPANY, WORTH US$3.4 TRILLION, UP 34%, ON THE BACK OF AI AND CLOUD COMPUTING.

NVIDIA UP TWO PLACES TO THIRD, ADDING US$6BN A DAY FOR THE PAST YEAR TO TRIPLE ITS VALUE TO US$3.1 TRILLION.

ALPHABET ADDED US$728BN TO US$2.3 TRILLION AND AMAZON ADDED US$640 BILLION TO US$2 TRILLION, TO ROUND OUT TOP 5.

SAUDI ARAMCO AT SIXTH PLACE WITH US$1.9 TRILLION

TAIWAN-BASED TSMC UP TWO PLACES TO EIGHTH, UP 76% TO US$903 BILLION.

WEIGHT-LOSS DRUGS CONTINUE TO BOOM. ELI LILLY UP 54% TO US$812 BILLION TO MAINTAIN TOP TEN SPOT, AND NOVO NORDISK UP 49% TO US$644 BILLION AND 12TH PLACE.

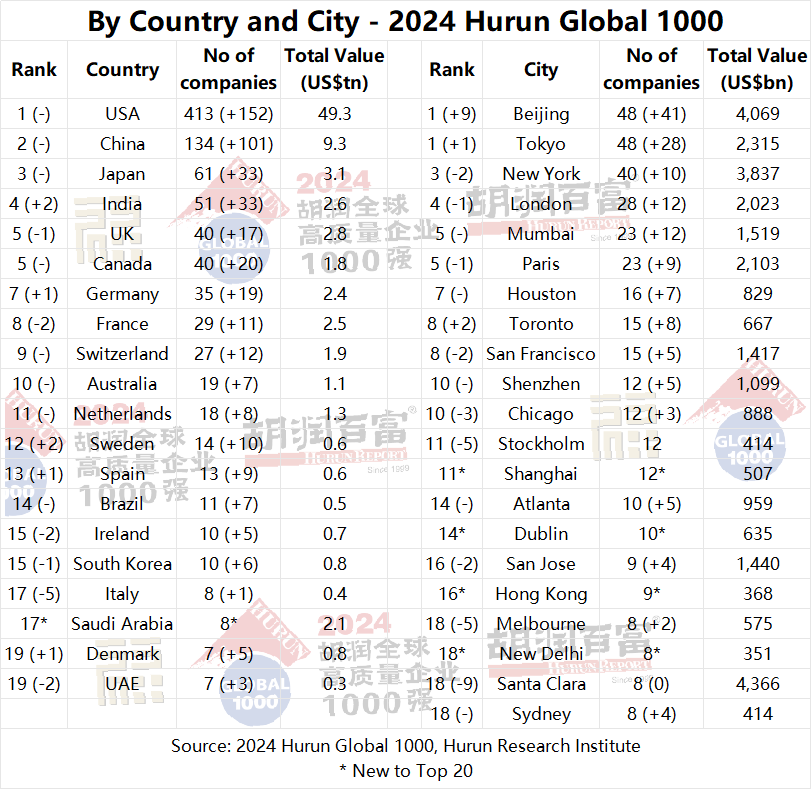

BY COUNTRY. USA LED WITH 413 COMPANIES, AHEAD OF CHINA 134. JAPAN THIRD WITH 61.

INDIA OVERTOOK UK AND CANADA TO FOURTH PLACE WITH 51 COMPANIES.

BEIJING AND TOKYO JOINT NUMBER ONE CITIES, EACH WITH 48 HURUN G1000 COMPANIES.

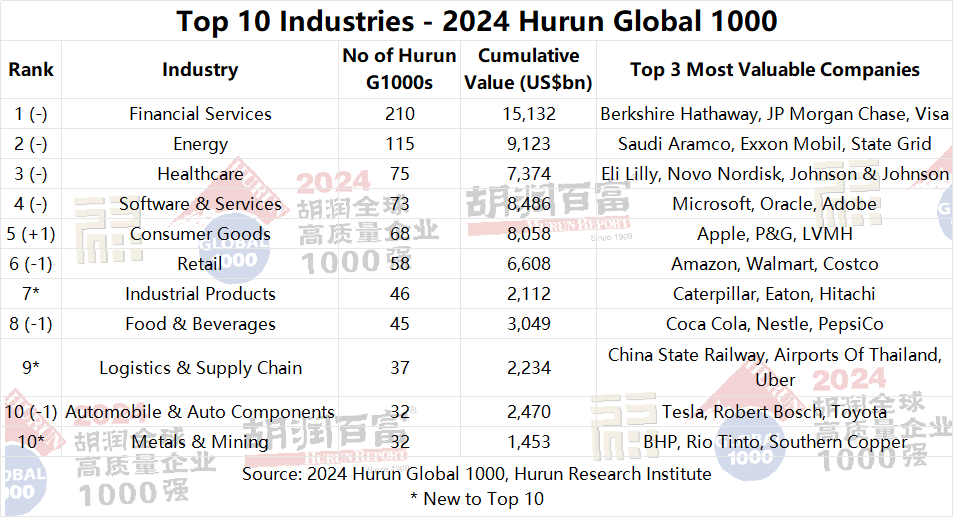

FINANCIAL SERVICES LED THE WAY WITH 210 COMPANIES, FOLLOWED BY ENERGY WITH 115 AND HEALTHCARE WITH 75.

AVERAGE AGE 67 YRS, FOUNDED 1957. 17% FOUNDED IN THE 2000s, WITH YOUNGEST LED BY ELON MUSK’S OPENAI CHALLENGER XAI, MALTA-BASED CRYPTOCURRENCY EXCHANGE BINANCE, SAN FRANCISCO-BASED AI LLM PLATFORM DATABRICKS, CHINA CROSS-BORDER ECOMMERCE PLATFORM PINDUODUO, CHATGPT OWNER OPENAI AND BEIJING-BASED HYBRID CAR MAKER LI AUTO.

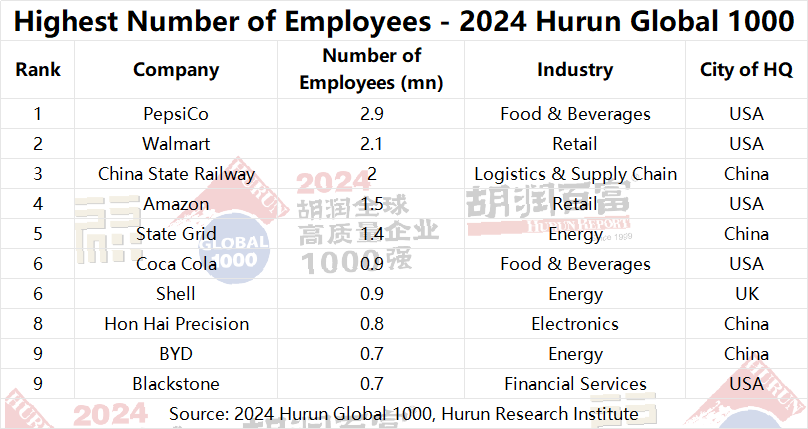

USA COMPANIES EMPLOYED ALMOST 30 MILLION STAFF, FOLLOWED BY CHINA WITH 20 MILLION AND GERMANY WITH 5 MILLION. PEPSICO LED THE LIST WITH THE HIGHEST NUMBER OF EMPLOYEES, TOTALING 2.9 MILLION.

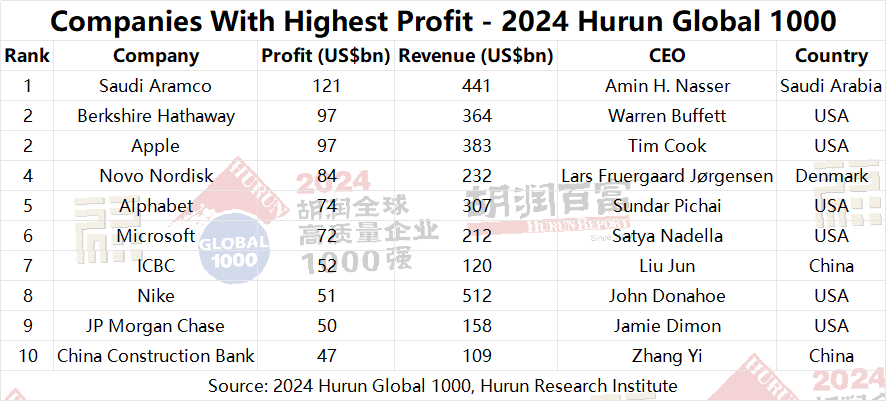

SAUDI ARAMCO MADE PROFITS OF US$121 BILLION, HIGHEST ON LIST.

MUMBAI STOOD OUT AS THE PRIMARY HUB FOR INTERNATIONAL COMPANIES IN INDIA, WITH 136 FIRMS, FOLLOWED BY BENGALURU WITH 52 AND GURUGRAM 38.

HURUN RESEARCH INSTITUTE TODAY RELEASED

2024 HURUN GLOBAL 1000

(14 January 2025, Shenzhen, China, Mumbai, India, and Oxford, UK) Today, the Hurun Research Institute released the 2024 Hurun Global 1000, ranking the 1000 most valuable companies in the world. Companies were ranked according to their value, defined as market capitalisation for listed companies and valuations for non-listed companies. The cut-off date used was 20 September 2024. This is the 5th year of the list, which expanded to 1000 companies, up from 500 last year and includes state-controlled companies for the first time.

382 of last year’s Hurun Global 500 were up, and only 116 saw their value drop. There were 502 new faces. The cut-off to the Hurun Global 1000 was US$19.8bn. Total value came to US$87tn. 56% sell direct to consumers, whilst 44% are B2B. 53% sell physical products and 47% sell software and services. By value, five industries make up half the Hurun Global 1000, led by Financial Services, Energy, Software & Services, Consumer Goods and Semiconductors. On average, these 1000 companies are 67 years old and are worth US$87bn, derived from sales of US$40bn and 80,000 employees.

90% were listed companies, with only 10% non-listed, led by Beijing-based State Grid with a value of US$350bn followed by China State Railway Group at US$300bn.

In the period of 31 October 2023 to 20 September 2024, the S&P 500 was up 39%, India’s Sensex 33%, the NYSE Composite 32%, EURO STOXX 50 21% and the FTSE 100 by 13%. The Shanghai Composite was down 9.3%.

During the same time frame, the US dollar appreciated against most major currencies in the world: up 8% against the British Pound, 5.9% against the Japanese Yen, 5.5% against the Australian Dollar, 4.7% against the Russian Ruble, 4.6% against the Euro and 3.6% against the Chinese Yuan. It was flat against the Indian Rupee. Meanwhile, Bitcoin outperformed all traditional markets, increasing by 77% to reach US$60,382.

Rupert Hoogewerf, chairman and chief researcher of Hurun Report, said:

“If you want to understand the world economy, then the Hurun Global 1000 is the place to start. They are the backbone to the world economy. Between them, these 1000 companies had combined sales of US$40tn, roughly twice the combined GDPs of China and India, and employ 80 million staff, equivalent to the working population of the UK and France combined.”

“The Hurun Global 1000 are the companies that investors believe are likely to generate the most profits going forward over the next ten or so years.”

“AI technologies are accelerating the concentration of economic power. Big companies are getting bigger. We now have seven trillion-dollar businesses on our list, up from four in 2020, when we did our first list. The value of the Top 10 has almost doubled to US$19.7tn, up from US$10.3tn in 2020, making them now five times the size of India’s GDP.”

“It has been a good year for Semiconductors, Financial Services, especially Banks, Healthcare, especially Pharma and Medical Devices, and Software & Services. The US was far and away the best performer. It has been a relatively bad year for Oil & Gas.”

“AI value is being generated first in computing power, with the likes of Nvidia, Broadcom and Arm surging ahead. The software and services side is being led by the likes of Microsoft, Alphabet and Amazon as well as OpenAI.

“Money managers like Vanguard, managing US$9.9tn of assets, made the Hurun Global 1000 for the first time.”

“Bitcoin recently soared to an all-time high, surpassing US$100k for the first time, fueled by anticipation of Donald Trump's return to the White House and potential crypto-friendly regulations. The appetite for crypto saw the value of Coinbase and Binance grow.”

“Healthcare was one of the best performers this year. Normally Big Pharma grows modestly, but Eli Lilly saw its value surge by 54% to US$812bn, along with Novo Nordisk, which saw a US$211bn increase, reaching US$645bn.”

“Amid the cost of living crisis, the retail sector has thrived, now valued at US$6.6 trillion, with 91% of companies registering an increase in value, as retailers adapted through e-commerce and enhanced customer experiences to meet heightened demand for essentials and a shift towards convenient shopping. German companies like Aldi Sued, Schwarz and Deichmann made the list for the first time, strengthening their market positions in tough economic times.”

“The USA dominated when it came to Hurun Global 1000 companies, home to 41% of the G1000 companies and worth 56% of total value, significantly ahead of second-placed China with 134 companies.”

“The cut-off used was just before Donald Trump won the presidency of the US. Since then, the US stock markets have gone up not inconsiderably, led by Elon Musk businesses, with Tesla more than doubling its value to become a trillion dollar business, SpaceX up to US$350bn to become the world’s most valuable unicorn and xAi doubling in value to US$50bn. Broadcom, TSMC and Berkshire Hathaway has since grown to become trillion dollar businesses, meaning there are now ten in the world.”

“While China’s percentage of the list has risen from 7% to 13%, this was mainly due to adding in state owned enterprises. 74 of China’s 134 companies are state-owned with 60 being non state-owned, or private companies. Overall, Chinese companies have suffered as the economy slowed this past year and domestic consumption remained low.”

“Russia. Energy businesses like Lukoil and Novatek have been directly impacted by the Russia-Ukraine conflict, with sanctions and worldwide supply disruptions limiting their expansion possibilities.”

“India has established a strong presence in the 2024 Hurun Global 1000 with 51 companies making the list, including 33 newcomers, and with 47 growing in value. The country has risen to fourth in the world, up two places. Over 40% are headquartered in Mumbai, emphasizing the city’s role as a vital business hub. Collectively, these companies have generated revenues of US$750 billion, showcasing the growing influence and strength of Indian enterprises on the world stage.”

“309 or 62% of the companies in the Top 500 of the Hurun Global 1000, which is ranked by value, are not on the Fortune Global 500, which is ranked by sales. The likes of ByteDance, worth US$240bn, did not make the latest Fortune list. Value changes as new information comes to light, such as impact of elections, innovations, interest rates, inflation, government data, regulations and economic confidence. Value reflects the future profit-making ability of companies. Some companies had relatively small sales and yet still made the Hurun Global 1000. San Francisco-based cloud services platform Databricks had sales of only US$1bn, yet was worth US$43bn. Close behind was OpenAI, with sales of US$1.3bn, yet worth US$150bn. US-based AdTech The Trade Desk had sales of US$1.6 billion, yet still achieved a valuation of US$48bn. Value reflects the future profit-making ability of companies.”

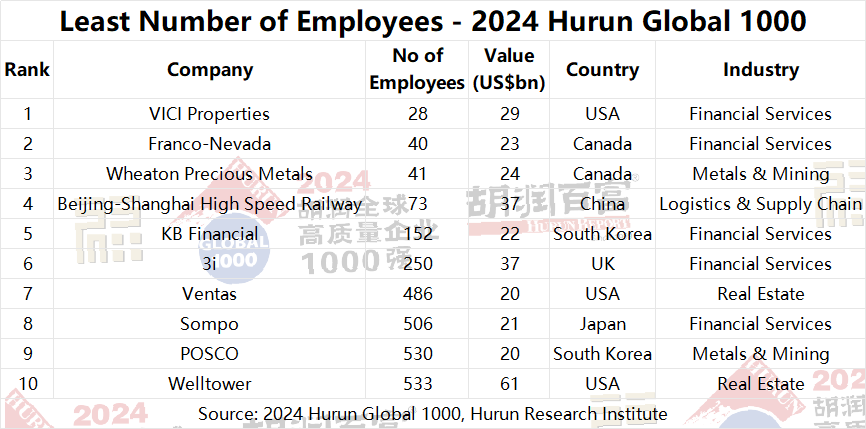

“Three of the Hurun Global 1000 have less than 50 employees and yet make our cut: VICI Properties, Franco-Nevada and Wheaton Precious Metals have values of US$29bn, US$23bn and US$24bn.”

“The Hurun Global 1000 are mostly multinationals. Linde, for example, was founded in Germany, is headquartered in the UK, registered in Ireland and listed in New York. Only 20% have significantly all of their operations in only a single country.”

“15 companies from the Hurun Global 1000 are headquartered in countries different to where they started. By country of destination, Ireland and the UK led the way with 4 companies each, followed by the Netherlands with 3 and Switzerland with 2.”

“Value creation is changing rapidly. The best performer these five years, i.e., since Covid, has been Nvidia, which added almost US$3tn, followed by Microsoft, Apple, Alphabet and Amazon, which both added over US$1tn. The worst performers were PayPal down just under US$200bn, three US-based telecoms companies Charter Communications, Verizon and AT&T, down US$240bn between them, entertainment companies Walt Disney and Comcast down US$84bn and US$83bn, Intel, down US$81bn, Nike, down US$71bn, and Pfizer, down US$63bn.”

“One in ten of the Hurun Global 1000 are not public companies. The most valuable companies in the world that have not yet gone public are led by China-based State Grid and China State Railway Group. Others of note include Robert Bosch, ByteDance, SpaceX, German retailers Aldi and Schwarz, as well as US energy giant Koch Industries and money managers Vanguard and Ares Management.”

The Top 10

The Top 10 was worth US$19.7tn, accounting for 22% of the Hurun Global 1000 total value. The Top 10 grew at an average of 63%.

Microsoft overtook Apple and Nvidia broke into the Top 3. Saudi Aramco was the only state-controlled company in the Top 10. 8 were from the US and one from each of Saudi Arabia and China.

Where are they based?

The USA led with 413 companies valued at US$49tn, substantially ahead of China with 134 companies worth US$9.3tn. Japan was third with 61 companies worth US$3.1tn. India moved up two places to fourth place with 51 companies valued at US$2.6tn.

Of China’s 134 companies, 74 were state-controlled companies and 60 were non state-controlled companies. The best performers were Taiwan-based semiconductors TSMC (up US$391bn) and MediaTek (up US$15bn). Others that had a good year include Tencent (up US$71bn), Hon HaiPrecision (up US$34bn) and Midea (up US$20bn). The worst performers were Nongfu Spring (down US$28bn), AIA (down US$26bn), as well as NetEase, Li Auto and Pinduoduo.

By city, Beijing shot up to joint first place with Tokyo, on the back of adding in state-owned enterprises for the first time. Both Beijing and Tokyo overtook last year’s Number One New York.London was down one place to fourth, while Mumbai and Paris rounded out the Top 5.

By continent, Asia overtook Europe for the first time.

The EU had 133, mainly made up of Germany with 35, France with 29.

16 from Southeast Asia, led by Indonesia, Singapore and Thailand, each with 5, and Malaysia with 1.

17 from the GCC, led by Saudi Arabia with 8, the UAE with 7 and Qatar with 2.

The West had 494 companies, mainly made up of the USA with 413 and the UK and Canada, each with 40.

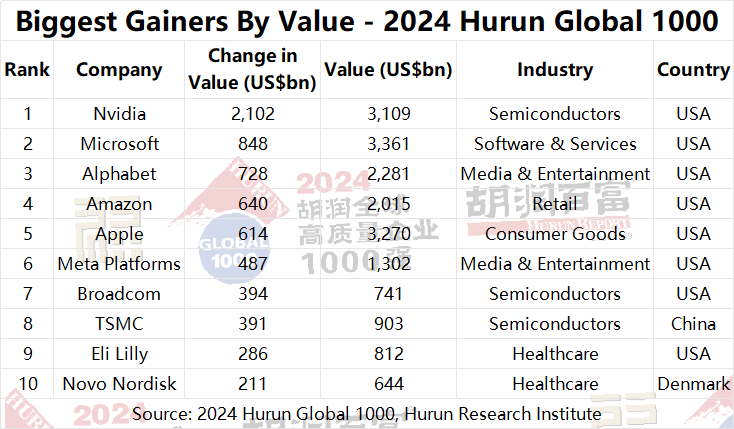

Top Gainers: Who’s on the Rise

382 companies saw their values rise, up an average of 18%. There were 502 new faces, as the list expanded to 1000, up from 500 companies in previous years. Of the Top 10 biggest risers of the year, 8 were in AI, of which 3 in computing power and 5 in software services. Two were in healthcare.

Nvidia was the year’s biggest riser, adding US$2.1tn of value and underscoring its pivotal role in AI, powering everything from data centres to autonomous vehicles. Broadcom and TSMC also made the Top 10 biggest risers.

Microsoft, Alphabet and Amazon added a further US$2.2tn of value in the past year as the world’s giant technology companies expanded their AI offerings, especially across cloud services.

Weight-loss drugs Zepbound and Ozempic helped Eli Lilly and Novo Nordisk add US$496bn in value.

Others that had a very good year included Crowdstrike, Dell, KKR& Co and Spotify, which all doubled their valuations.

Financial Services, particularly banking and insurance, has grown, benefiting from lower interest rates.

In the five years since 2019, the chip-making industry has seen the most value generated, led by Nvidia adding US$2.8tn, Broadcom US$577bn, ASML US$215bn, ADM US$146bn and Applied Materials US$115bn. Big pharma Eli Lilly, Novo Nordisk, Merck & Co and AbbVie added US$1.4tn between them. Big oil companies like Exxon Mobil, Chevron,Shell and Conoco Philips added US$660bn between them. Banks like JP Morgan Chase, Wells Fargo and Mitsubishi UJF Financial added US$350bn, and credit cards Visa, Mastercard and American Express added US$245bn. Others include Microsoft US$1.7tn, Apple US$1.1tn, Alphabet US$1.1tn and SpaceX, which more than tripled in value to US$350bn.

New faces

There were 98 new entries in the top 500 this year, up from 48 last year, mainly made up of state-owned companies, which were included for the first time this year.

The ten biggest new faces were all state-owned companies, led by energy giant Saudi Aramco. The other seven were from China and two from Thailand.

Money managers Vanguard and Ares Management made the list for the first time.

Other notable newcomers include UK-based Arm, India-based Hindustan Unilever, India-based Tata Motors, Germany-based Porsche, UK-based Barclays, UK-based Ineos and South Korea-based LG Energy Solution.

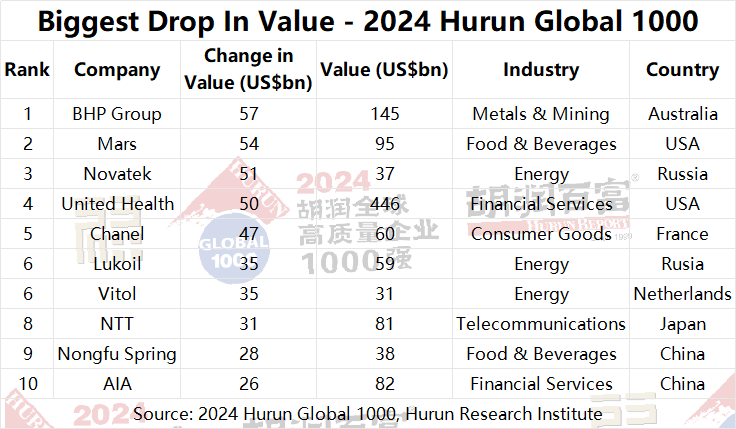

Biggest drops

116 companies from last year’s list saw their value go down, led by Australia-based mining giant BHP, which lost US$57bn to US$145bn, due to fluctuating commodity prices, reduced demand from China, and rising environmental costs.

In the five years since 2019, PayPal has seen the biggest loss in value, down US$193bn. Others included three US-based telecoms companies Charter Communications, Verizon and AT&T, down US$240bn between them. Entertainment companies Walt Disney and Comcast were down US$84bn and US$83bn, Intel, down US$81bn, Nike, down US$71bn, and Pfizer, down US$63bn.

Mars saw the second biggest drop, down US$54bn to US$95bn, on the back of changing consumer habits in the US especially, where the rise of weight-loss drugs has reduced demand for sugary snacks and sparked a broader shift towards healthier eating.

Russia-based Energy businesses Novatek and Lukoil were both down, as sanctions bit.

United Health’s value dropped US$50bn to US$446bn. Rising healthcare costs, increased competition, and regulatory pressures in the U.S. have impacted its growth and profitability.

Chanel was down US$47bn to US$60bn, reflects a shift towards digital-first luxury and sustainability, rising production costs, and growing competition from emerging luxury brands.

Energy trader Vitol was down US$35bn to US$31bn, on the back of fluctuating energy prices, geopolitical instability, and the global shift to renewable energy.

Industry Trends: Top Performers and Underperformers

Overall, Financial Services led the way for the Hurun Global 1000, followed by Energy, Healthcare and Software & Services.

Financial Services remains the leading sector, with 210 companies valued at US$15tn. This growth is driven by increasing demand for digital finance and investment products and the continued global expansion of fintech.

Energy followed, with 115 companies valued at US$9tn. While traditional energy sources continue to benefit from global demand, the sector is under pressure from the global shift towards renewable energy and ongoing geopolitical tensions.

Youngest

The average age was 67 years, i.e. the Hurun Global 1000 started out on average in 1957.

There were only six startups from the last ten years that made our cut. 174 or 17% were set up in the 2000s, The youngest startup to make the Hurun Global 1000 was the 2023-founded xAI, founded by Elon Musk, which aims to take on OpenAI’s ChatGPT. xAI raised its first round at a valuation of US$24bn and is said to have since raised a second round at a valuation of US$50bn.

The other youngest startups include crypto currency exchange Binance from 2017 and today worth US$30bn, OpenAI from 2015 and today worth US$150bn, and Pinduoduo, Adani Green Energy and Li Auto, all three from 2015, and today worth US$138bn, US$33.7bn, US$23.3bn.

Some of the youngest companies are spin-offs or mergers. Kenvue and Haleon were both spun off in 2022, from Johnson & Johnson and GlaxoSmithKline.

High Value, Lean Workforce

VICI Properties, Wheaton Precious Metals and Franco-Nevada each have less than 50 employees and yet have values of US$29bn, US$24bn and US$23bn respectively.

Top Revenue Giants of 2024

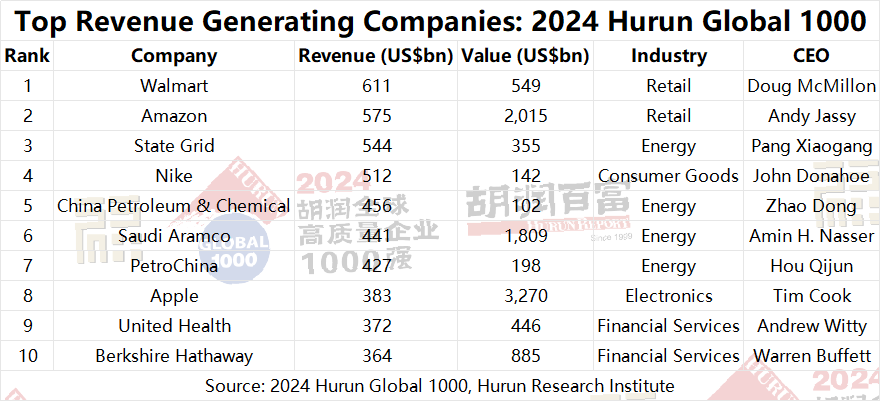

In Retail, Walmart and Amazon stand out. Under Doug McMillon, Walmart is strengthening its physical retail footprint, while Amazon, led by Andy Jassy, is expanding into AI-driven e-commerce and sustainable logistics.

Energy sector leaders like State Grid, China Petroleum & Chemical and PetroChina underscore the enduring importance of energy infrastructure and resource management in global markets. Pang Xiaogang, Zhao Dong, and Hou Qijun helm these companies, steering their focus toward energy efficiency and sustainability.

Among Consumer Goods leaders, Nike and Apple capitalise on brand loyalty, with Nike focusing on direct-to-consumer channels and Apple growing its services ecosystem, including Apple Pay.

Financial Services powerhouses United Health and Berkshire Hathaway showcase sector strength. United Health is broadening healthcare access, and Berkshire Hathaway’s diversified investments continue to thrive amid economic shifts.

Top Companies by Workforce Size

Despite automation trends, PepsiCo, Walmart, and China State Railway led the way with the number of employees.

Top Profit-Makers of 2024

Saudi Aramco was the most profitable company in the world last year, making US$121bn in profits, leveraging its dominant position in the global energy market under Amin H. Nasser's leadership. Berkshire Hathaway and Apple tied for the second top, each with US$97bn profits. Berkshire Hathaway, under Warren Buffett, leverages its unique portfolio, recently increasing investments in AI-related ventures like Amazon and Nvidia, signalling a cautious yet strategic dip into tech. Meanwhile, Apple, led by Tim Cook, continues to drive its profit margins through strong brand loyalty and pricing strategy, alongside growth in services like Apple TV+ and the App Store.

Novo Nordisk generated US$84bn in profit, riding a wave of demand for diabetes and obesity treatments and a global focus on preventive healthcare. Under Lars Fruergaard Jørgensen, the company's investment in obesity care has boosted revenue and attracted significant attention in the healthcare industry.

Tech leaders Alphabet and Microsoft show the profitability of digital ads and cloud computing, with profits of US$74bn and US$72bn, respectively. Microsoft's recent push into AI and strategic partnership with OpenAI has positioned it at the forefront of tech innovations. At the same time, Alphabet’s ad revenue growth signals resilience even in a shifting digital landscape.

Stats

In 2024, Hurun expanded the list to the 1000, up from 500, and included state-owned companies for the first time.

2024 Hurun Global 1000 Top 100

For the full list, please see www.hurun.net

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai

Established in the United Kingdom in 1999, Hurun is a research and media group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion-leader in the world of business, Hurun generated 8 billion views on the Hurun brand in 2023, mainly in China and India, and recently expanding to the UK, US, Canada and Australia.

Best-known for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s other key series focus on young businesses and entrepreneurs, through the Hurun Unicorns Index, two Hurun Future Unicorns indices, the Hurun Uth series and the Hurun Pioneers series.

Hurun has grown to become the world’s largest list compiler for start-ups, ranking over 3000 start-ups across the world through its annual Hurun Global Unicorns Index (startups with a valuation of US$1bn+), and two Hurun Future Unicorn Indexes: Gazelles, most likely to ‘go unicorn’ within three years, and Cheetahs, most likely to ‘go unicorn’ within five years.

The Hurun Pioneering Young Startups and Entrepreneurs series focuses on startups set up within the last ten years and founders aged 45 or under.

The Hurun Uth series includes the Under25s, Under30s, Under35s and Under40s awards, representing the cream of each generation of young entrepreneurs who have founded businesses with a social impact and worth US$1m, US$10m, US$50m and US$100m respectively.

Other lists include the Hurun 500 series, ranking the most valuable companies in the world, China and India, the Hurun Global High Schools List, ranking the world’s best independent high schools, the Hurun Philanthropy List, ranking the biggest philanthropists and the Hurun Art List, ranking the world’s most successful artists alive today.

Hurun provides research reports co-branded with some of the world’s leading financial institutions and regional governments.

Hurun hosts high-profile events across China and India, as well as London, Paris, New York, LA, Toronto, Vancouver, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

财华网所刊载内容之知识产权为财华网及相关权利人专属所有或持有。未经许可,禁止进行转载、摘编、复制及建立镜像等任何使用。

如有意愿转载,请发邮件至content@finet.com.hk,获得书面确认及授权后,方可转载。

更多精彩内容,请登陆

财华香港网(https://www.finet.hk/)

财华智库网(https://www.finet.com.cn)

现代电视(http://www.fintv.hk)